dependent care fsa vs tax credit

You can and sometimes should utilize both an. Estimate your expenses carefully.

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Dependent Care Flexible Spending Account Health Flexible Spending Account vs.

. That comes out to 18576 in annual benefits for a single person or 37152 per year for a couple --. In other words it is possible to allow the non-custodial parent to claim the child for the tax credit while you claim the dependent care expense. Dependent Care FSA vs Child Tax Credit 2021.

Health Flexible Spending Account vs. Due to the IRS use it or lose it rule you will forfeit any money remaining in your 2020. Approximate value of fully utilizing the Dependent Care Tax Credit in 2021.

Dependent Care Flexible Spending Account. As for FSA vs tax credit - you dont pay any federal income tax and the child care tax credit isnt refundable so you wont get any benefit from that. Its not a straightforward question.

It will only be applicable to the expenses that exceed your Dependent Care FSA contributions. For example if you have two children and 16000 or more in childcare costs. 5000 is the maximum whether for one child or.

The average Social Security benefit for retired workers is 1548 per month. The child and dependent. Dependent Care FSA vs.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit. It leads us to have the same conversation every year during open enrollment over whether and how much to contribute to the Dependent Care FSA. Calculate an accurate Federal tax rate estimate here.

The purpose of the change was not for this. Enter your expected dependent care expenses for the year ahead. Theres also no income taxes to save on.

Child Care Tax Credit You have another option for saving money on dependent care expenses via lowering your taxable income. A Dependent Care FSA allows an employee married filing jointly to defer up to 5000 pre-tax from their paycheck each year. The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children.

Form 2441 should be filed along with your 2021 tax return to take advantage of the Dependent. Read about it here. The credit may be reduced if you.

No you can not elect to include the FSA funds in your income and tax the dependent care deduction. April 11 2022 735 PM. The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA.

Parents who are looking. Dependent Care FSA. But like the Dependent Care FSA the American Rescue Plan Act ARPA has also increased the credit limits for the Child and Dependent Care tax credit for 2021.

60 Important Papers And Documents For A Home Filing System Checklist Estate Planning Checklist Home Filing System Funeral Planning Checklist

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Coh Dependent Care Reimbursement Plan

For Those Of Us Who Do Our Own Taxes That Means Zeroing In On Every Tax Deduction Possible Here Are 10 Of The Most Co Tax Deductions Moving Expenses Deduction

Dependent Care Flexible Spending Account University Of Colorado

How Does A Dependent Care Fsa Work Goodrx

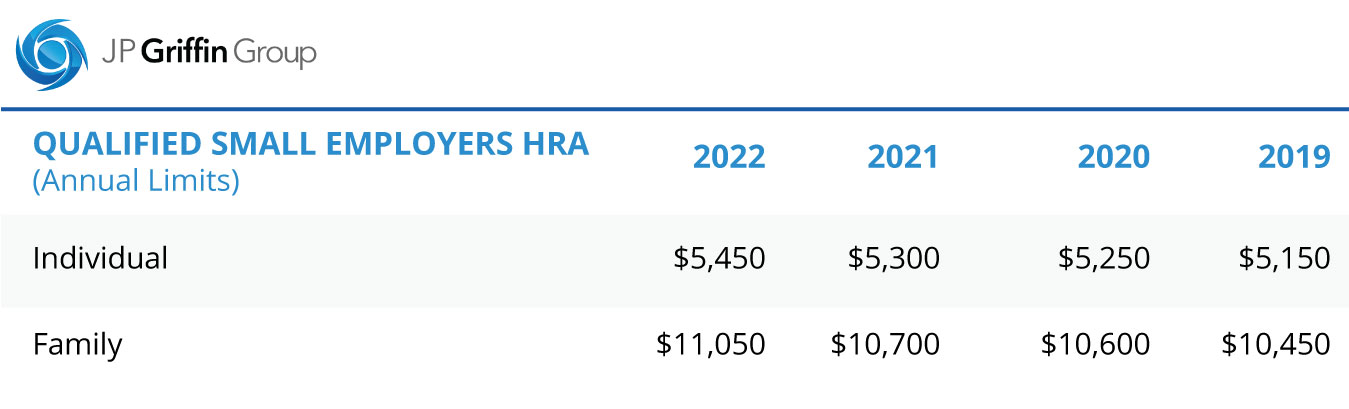

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flex Spending Accounts Hshs Benefits

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

A Dependent Care Fsa Can Help You Save Money On Childcare Costs Here S What To Know Childcare Costs Working Parent After School Care

Tax Extension Tax Extension Tax Services Tax

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Fsa Dcfsa Optum Financial

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Dependent Care Fsa Daycare Costs Affordable Daycare Christmas Savings